February 20, 2025

Abolition of rental value in Switzerland

Abolition of rental value: parliament gives green light, but with possible cantonal tax on second homes

February 20, 2024

Value Added Tax (VAT) Rates Worldwide: Overview of Consumption Taxes

The Value Added Tax (VAT) is one of the primary revenue collection tools in many countries around the world and can vary significantly from…

July 13, 2023

Liechtenstein and Italy sign against double taxation

As part of a virtual signing ceremony, Head of Government and Minister of Finance Daniel Risch, together with his Italian counterpart…

April 21, 2023

Switzerland will be removed from the Italian black list

Federal Councillor Karin Keller-Sutter and Italian Finance Minister Giancarlo Giorgetti signed a political declaration concerning the…

January 21, 2022

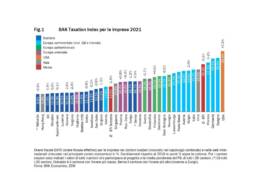

Swiss cantons improve their fiscal attractiveness

The "BAK Taxation Index" unveiled a drop from 16.9 percent to 13.9 percent in ordinary burden, using 2017 as the "pre-RFFA" baseline year

October 14, 2021

Differentiated regionalism? A compelling dissertation

On sale on "Swiss Federalism" the book that, in a clear and precise way, illustrates fiscal federalism and the opportunity of regional…

October 10, 2021

Corporate taxation: Switzerland requests more certainty from the OECD

Berne would like to see safeguards for the interests of smaller, economically strong countries and greater regulatory clarity for the…

July 31, 2021

Meeting in Bern between the heads of the Confederation and the OECD

Guy Parmelin and Ueli Maurer on taxation with Mathias Cormann, new Secretary of the Organization for Economic Cooperation and Development

July 1, 2021

And Switzerland will chair the European tax body…

Marc Bugnon, Director of the Federal Tax Administration, at the head of the Intra-European Organisation of Tax Administrations

June 11, 2021

Towards measures for a competitive Swiss economy

In the context of the fiscal policy of the OSCE and G20, Bern will focus on innovation, sustainable growth, a high level of prosperity and…

June 3, 2021

For Standard & Poor’s Liechtenstein is a triple A country

In its report of May 31, 2021, the agency S&P Global confirmed the Principality's rating with the highest expected grade on account of the…

June 2, 2021

When the real problem is not the “how much” but the “why”

The issue of tax pressure in Italy is never addressed from the point of view of the people, but always and only from the technical point of…

May 19, 2021

364.3 million requested for federal buildings

The government has adopted the 2021 dispatch on constructions that are useful to Switzerland, from the Swimming Centre in Tenero to the…

May 19, 2021

New inheritance law effective January 1, 2023

In future, Swiss heirs will be able to freely dispose of a larger portion of the estate, with a reduction for their children from three…

May 17, 2021

BAK Economics: “No strong inflation in Switzerland…”

Rising prices are creating unease and concern, but the institute with offices in Basel, Zurich and Lugano believes the fears are unfounded,…

May 15, 2021

Still very little interest in the carry-over procedure

Direct VAT payments for imports to the Federal Tax Administration instead of the Federal Customs Administration do not take off