Towards measures for a competitive Swiss economy

In the context of the fiscal policy of the OSCE and G20, Bern will focus on innovation, sustainable growth, a high level of prosperity and attractive jobs

At its meeting on 11 June 2021, the Federal Council took note of the planned procedure for the further strengthening of Switzerland as a business location in the context of the work within the Organisation for Economic Co-operation and Development and the Group of 20 on international corporate taxation.

Depending on the progress of the international work, the Federal Council will decide on a coordinated reform plan in the first quarter of 2022.

It is now important for Switzerland to lay the foundations for establishing itself as a competitive business location with sustainable growth, innovative capacity, attractive jobs and a high level of prosperity, also in the context of the work of the OECD and the G20 on international corporate taxation.

The work of the OECD and the G20 on international corporate taxation is progressing.

A group of experts will improve the Swiss tax center

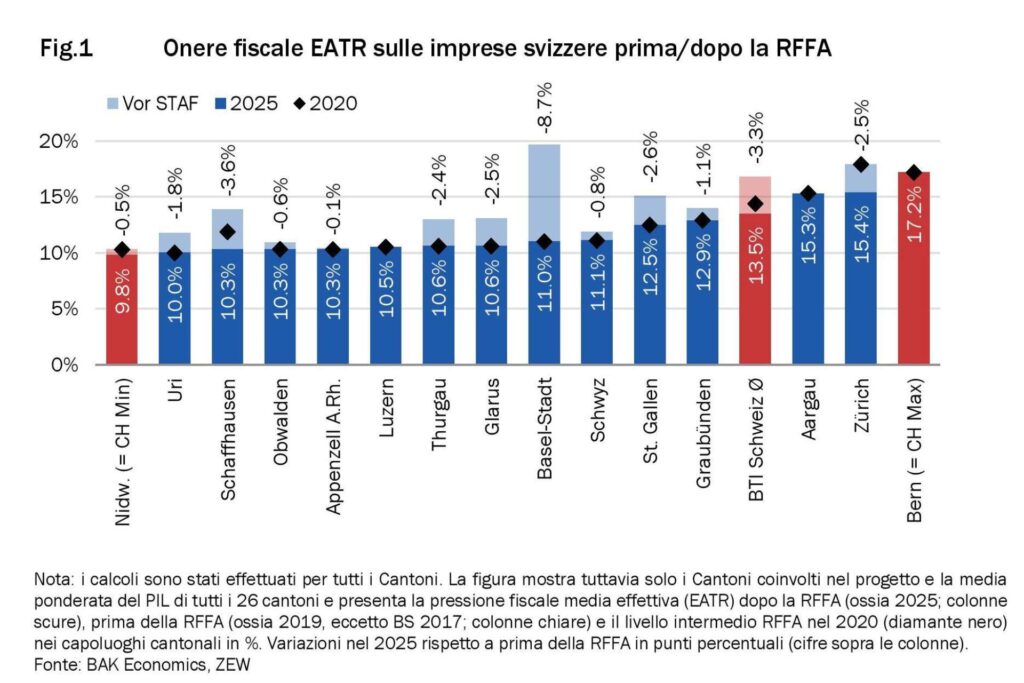

In 2025 Nidwalden will be the best “tax haven” in the world

G7 agrees to a minimum tax rate of 15% on multinationals

The G7 finance ministers recently agreed on a global minimum tax rate of 15% for large multinational companies.

In addition, it is intended to increase the tax share of marketing states on the profits of certain multinational companies with high profits.

It is assumed that the OECD will reach a political understanding on certain indicators by mid-2021 and will develop detailed provisions by the end of the year.

Taxation, sixteen fields of action for the Switzerland of the future

In Italy, the tax burden has risen to 43.1%

Internationally accepted, but effective, instruments

For the past year, the Federal Department of Finance (FDF) has been examining the possibility of introducing an international standard into Swiss law in talks with the cantons and with representatives of the scientific and business community, as well as the definition of measures that would make Switzerland an attractive business location and are internationally accepted.

In the coming months, the FDF will intensify this work in close collaboration with the Federal Department of Economic Affairs, Education and Research and other departments involved in the project.

Depending on the progress of the OECD and G20 work, a coordinated reform plan will be submitted to the Federal Council in the first quarter of 2022.

Bern, Zurich and Aargau focus on fiscal innovation

When the real problem is not the “how much” but the “why”