Corporate taxation: Switzerland requests more certainty from the OECD

Berne would like to see protection for the interests of smaller, economically strong countries and greater regulatory clarity for the companies concerned

Switzerland is calling for legal certainty in the implementation of the principles of international corporate taxation.

On October 8, 2021, the Inclusive Framework of the OECD, to which 140 countries including Switzerland belong, defined the principles of future taxation of internationally active large companies, which were already published in July 2021.

The Swiss Confederation is calling for the interests of smaller, economically strong countries to be taken into account in the implementation and for legal certainty to be created for the companies concerned.

At the beginning of July 2021, the Inclusive Framework of the Organisation for Economic Co-operation and Development published the first principles of the future taxation of large companies.

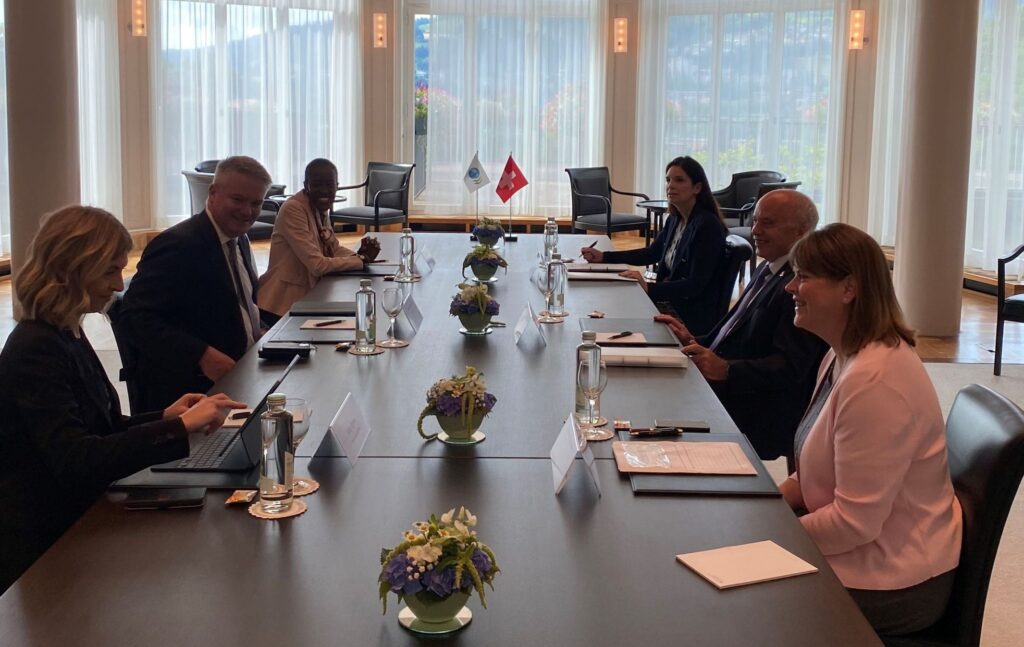

Meeting in Bern between the heads of the Confederation and the OECD

Only a few aspects of importance to Bern ascertained to date

Since then, it has only been possible to ascertain a few important aspects for Switzerland: A moderate transfer of the new taxing rights to the marketing countries and the binding abolition of unilateral digital taxes are planned.

A tax rate of 15% is to be applied as part of the overall minimum taxation. It is also planned to introduce minimum taxation rules gradually. This measure is in favour of countries with a relatively long legislative process, such as Switzerland.

Switzerland is the country with the greatest capacity for innovation

Towards rules geared towards innovation and the welfare of all

Other issues of importance to Switzerland are still pending but should be fleshed out in the coming months.

In this regard, the Alpine country is committed to innovation- and welfare-oriented rules that can be applied unilaterally worldwide and are subject to a dispute settlement mechanism.

The aim is to create legal security for the companies involved. Criticism from Switzerland and other countries concerns the OECD’s timetable, which does not take due account of national legislative processes.

For Switzerland, it will not be possible to introduce the new rules in 2023 as envisaged by the OECD. Federal Councillor Ueli Maurer reiterated this at the OECD Ministerial Meeting on October 5 and 6, 2021 in Paris.

At the same time as the other work of the Organisation for Economic Co-operation and Development, the Federal Department of Finance, in close co-operation with other departments and involving cantons, cities, the business sector and the scientific community, will draw up proposals for the attention of the Federal Council by the first quarter of 2022 which guarantee companies the best possible framework conditions for sustainable growth and are recognised internationally.

Taxation, sixteen fields of action for the Switzerland of the future