Swiss cantons improve their fiscal attractiveness

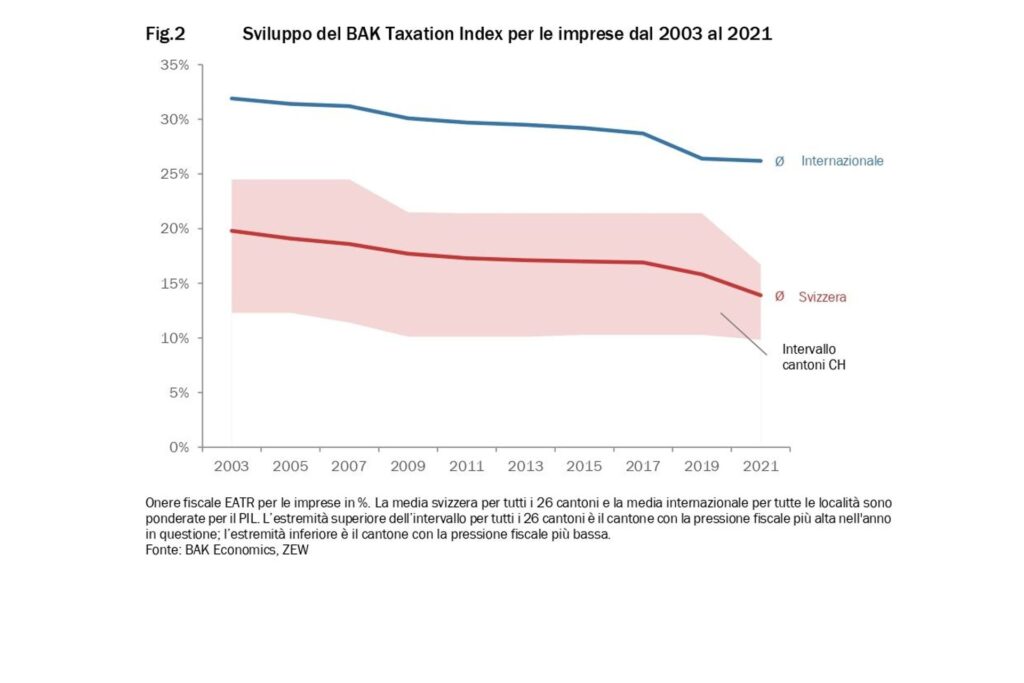

The “BAK Taxation Index” unveiled a drop from 16.9 to 13.9 percent in the ordinary burden, using 2017 as the “pre-RFFA” reference year

The “BAK Taxation Index“, produced by the research institute BAK Economics with offices in Bern, Basel, Lugano and Zurich, shows that in Swiss cantons the tax burden for businesses with ordinary taxation has decreased significantly as a result of the Tax Reform and Financing of the Old Age and Survivors’ Insurance (RFFA).

At the same time, the tax burden of internationally competing locations has remained relatively stable over the past two years. This has led to a further improvement in the tax attractiveness of Swiss cantons.

For the first time, a Swiss canton has replaced Hong Kong at the top of the ranking, with several other federal territories in close proximity.

Corporate taxation: Switzerland requests more certainly from the OECD

An analysis made effective because of the ordinary tax burden

The BAK Taxation Index regularly measures the ordinary tax burden for companies in Swiss cantons and their most important international competitors.

The current edition examines how the RFFA, which came into effect at the beginning of 2020, has affected the attractiveness of the cantons in the international tax competition arena.

This analysis focuses on the ordinary tax burden, while it does not consider either the situation of companies that have previously benefited from cantonal tax privileges or the specific tax-reducing effects of STAF’s research and development instruments (Patent Box and R&D Deductions).

Taxation, sixteen fields of action for the Switzerland of the future

The RFFA has reduced the tax burden by about 3 percent

Over the past two years, most cantons have lowered their profit and capital taxes under the RFFA.

Overall, in many places this has resulted in a clear reduction in the effective tax burden (EATR) for businesses.

The GDP-weighted average of all 26 cantons fell by -1.9 percentage points, or from 15.8 percent to 13.9 percent between 2019 and 2021.

Adopting 2017 as the pre-RFFA baseline year to account for the fact that the cantons of Basel-Stadt and Vaud anticipated the reform, the decrease in the average is a full -3.0 percentage points (from 16.9 percent to 13.9 percent).

The changes in the effective tax burden between 2019 and 2021 range from 0 (no change) to about -10 percentage points, depending on the canton.

Cantons in which the tax burden was previously high (by Swiss standards) show a particularly strong decline. One consequence is that the differences between the Swiss territories have decreased.

Despite the many changes in the ranking, the regional pattern has remained relatively stable: Central Switzerland tends to have a low tax burden compared to the other regions, Eastern Switzerland medium and the other large regions rather high.

Global corporate taxation: yes from Switzerland, but with restrictions

Switzerland now leads international rankings

Since 2003 there has been an international trend towards reducing the effective tax burden on companies. Switzerland has followed this trend and has consistently shown taxation levels below the international average of the “BAK Taxation Index”. This applies not only to the Swiss average but also to the top 26 cantons.

While the Swiss cantons have significantly reduced their tax burden to the current level, international competitors have kept the burden relatively stable over the past two years.

The international GDP-weighted average of BAK’s taxation index fell by only -0.2 percentage points from 2019 (26.4 percent) to 2021 (26.2 percent).

In Europe, it is France (-5.2 percentage points) and Belgium (-2.0) in particular that have seen the largest reductions.

And Switzerland will chair the European tax body….

Nidwalden, Uri, Obwalden and Appenzell Ausserrhoden ahead of the pack

In an international comparison, the attractiveness of the Swiss cantons in terms of ordinary corporate taxation by the RFFA has thus improved.

In 2021 Nidwalden replaced the previous leader Hong Kong (9.9 percent) at the top of the international ranking, with a larger group of cantons such as Uri, Obwalden and Appenzell Ausserrhoden positioned in close proximity.

Switzerland’s GDP-weighted average is now lower than Singapore’s tax burden.

Similarly, Switzerland shows lower tax levels than neighboring countries, where the burden is between 8.6 (Austria) and 15.4 percentage points (Germany) above the Swiss average.

With the planned tax reform promoted by the OECD, to which Switzerland has also adhered, the Swiss cantons are already facing the new changes imposed by the RFFA.

In addition, the reform provides for minimum taxation for multinational companies with a turnover of 750 million euros.

It remains to be seen how this will affect international tax competition, especially for the many companies that fall below this turnover threshold.

Towards measures for a competitive Swiss economy

What is the calculation methodology of the “BAK Taxation Index”?

The “BAK Taxation Index” measures the tax attractiveness of all 26 Swiss cantons and their most important international competitor locations, namely by measuring the tax burden for companies and highly qualified employees.

For the Swiss cantons, the tax burden is measured at the capital city, and for international locations at the main economic center.

The “BAK Taxation Index” includes all relevant taxes at the various levels of government and shows the actual tax burden relevant to investors.

The “BAK Taxation Index” for companies measures the EATR tax burden, i.e. the actual tax burden borne by a company.

The index is calculated for a corporation that is composed of equal parts of different assets (intangible assets, industrial buildings, machinery, financial assets, inventories), that is financed through different sources (retained earnings, debt, new capital) and that has a pre-tax return of 20 percent.

The calculation takes into account the tariff burdens of the various taxes, the interaction between the taxes, and the most important regulations for determining the tax base (e.g., depreciation and inventory valuation rules).

This per-mits a comparison of charges for individual locations internationally. In contrast, a comparison based only on tariff rates would lead to an incomplete presentation of the tax burden.

The discussion about the competitiveness of a region and its attractiveness for businesses and residents is not only about the tax burden. Other location factors such as innovative capacity, quality of life, regulations, etc. also play an important role.

Since 2003, the “BAK Taxation Index” has been drawn up in cooperation with the Centre for European Economic Research (ZEW).

A group of experts will improve the swiss fiscal centre