Switzerland a global leader in reinsurance

Switzerland is one of the world’s leading locations for the reinsurance industry due to its hub in the financial center of Zurich, which operates global business and has very high productivity, strengthening Swiss exports and whose value added in 2020 amounted to nearly one-fifth of the total insurance value.

Reinsurance in brief

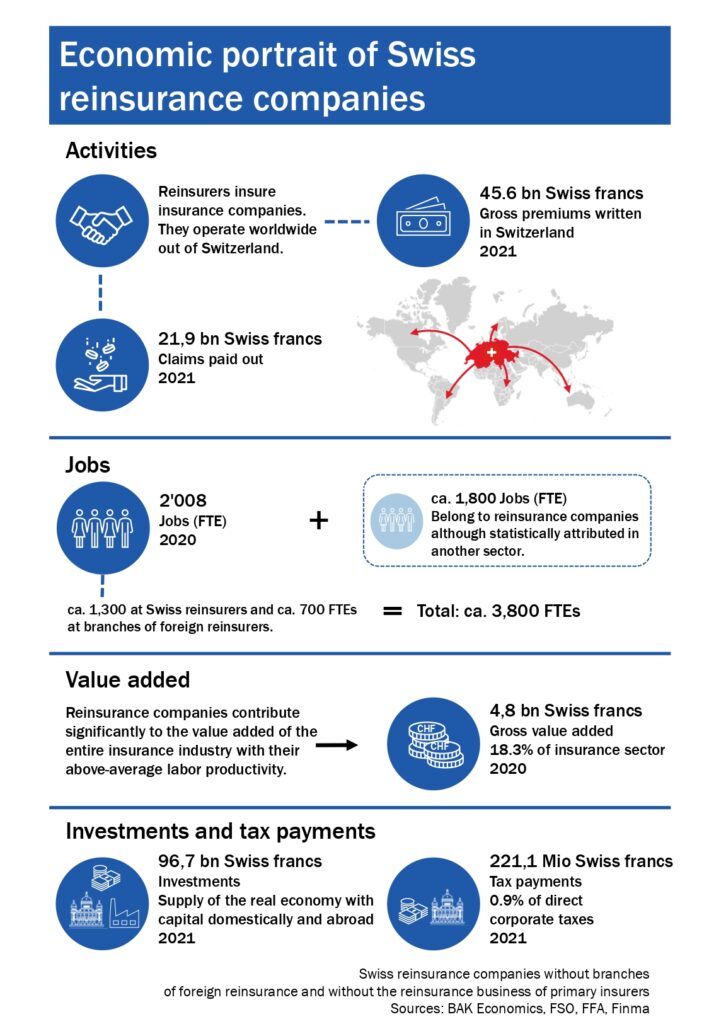

Reinsurance covers the risks of life, non-life and health insurance, contributing to their stability. This is why they are called the “insurers’ insurers.”

Switzerland is one of the world’s leading locations for this industry due to its hub in the financial center of Zurich. Swiss reinsurers are characterized by global activities and very high productivity, which strengthens Swiss exports.

Value added for the Swiss economy

In 2020, their value added amounted to 4.8 billion francs, nearly one-fifth of total insurance value added. The real economic output of reinsurance has more than tripled since 2000. These are some of the most important findings from the study conducted by BAK Economics on behalf of the Swiss Insurance Association (SIA).

Reinsurances support exports

Reinsurers operate worldwide from Switzerland, as their business model is based on global risk diversification to be able to insure even large and complex cases such as natural disasters. thus strengthening the Swiss export base. In 2021, gross premiums issued by Swiss reinsurers totaled 45.6 billion francs, including 19.4 billion in Europe, 17.3 billion in North America and 6.7 billion in the Asia-Pacific region.

In a webinar the revolution of the (re)insurance industry

Future outlook

In terms of premium volume, Switzerland is the third-largest reinsurance marketplace after the United States and Germany. The most important success factors are access to reinsurance markets worldwide, the regulatory environment, the availability of specialists, and political and macroeconomic stability.Swiss reinsurers have above-average productivity and generated gross value added of 4.8 billion francs in 2020, which is about one-fifth of total insurance value added. Over the past 20 years, reinsurance has more than tripled its real economic output. This means that the industry has expanded much more strongly than insurance sectors that focus on the domestic market.In the future, the reinsurance industry will also benefit from fast-growing foreign markets and thus has favorable development prospects.

Source: BAK Economics AG