Good prospects for Swiss winter tourism

According to tourism forecasts published by BAK Economics on behalf of the State Secretariat for Economic Affairs (SECO), demand for overnight stays in Switzerland will increase significantly in the winter of 2022/23 (+1.9 million, +13 percent, over the previous year).

Despite current challenges such as high inflation and the strong franc, the winter season looks favorable for Swiss tourism with and the recovery is expected to be supported by the return of foreign guests. However, the pre-crisis level of overnight stays will not be reached before winter 2023/24 due to negative effects such as the restrictive Covid-19 policy in China, the absence of Russian guests, and the tense economic situation.

Return of foreign guests and strong domestic tourist demand in summer 2022

The gradual lifting of global travel restrictions since last winter had a positive impact on Swiss tourism in summer 2022, with an increase of 3.6 million overnight stays. In contrast to 2021, both guests from distant markets (+2.7 million overnight stays) and guests from Europe (+1.9 million overnight stays) were welcomed back to Switzerland in increasing numbers. In Europe, the high costs and uncertainties of international air travel probably had a positive effect on demand. In June and August 2022, the number of overnight stays from the Netherlands, Belgium, France and Germany even significantly exceeded the pre-crisis level. After the excellent summer of 2021, a reduction of 1.1 million overnight stays (-8 percent) by guests from Switzerland had to be accepted, but despite this, the summer of 2022 saw excellent domestic demand, which was still nearly one-fifth higher than in 2019.

Swiss tourism despite all crises with strong growth

Difficult macroeconomic environment slows demand recovery in winter 2022/23…

In the coming winter (2022/23), several hindering factors will slow down the positive dynamics of tourism demand observed until recently. Rising energy prices triggered by the war in Ukraine, associated inflation and the economic slowdown are weighing on consumer sentiment both at home and abroad. In addition, the strong franc is making Switzerland more expensive, especially for guests from the euro zone and the United Kingdom. In contrast, Swiss guests are increasingly incentivized to vacation abroad.Then the long-term restrictions already in place in the summer remain: neither Chinese nor Russian guests are expected to see a noticeable increase in overnight stays in the winter. In addition, high airfares are straining the travel expenses of guests from long-distance markets, thus reducing demand from these countries. Business tourism is also expected to see a further reduction in travel.

… However, a multitude of favorable factors prevail

Despite the difficult economic environment, there are strong recovery and recovery effects in tourism demand. Many households have increased their savings in recent years and thus react less noticeably to price increases or economic setbacks in the short term than before the crisis. Another positive factor is greater planning certainty: travelers can assume that, as in previous years, relatively mild measures will be implemented in the event of another wave of infections in Switzerland. In long-haul markets, demand is thus expected to increase by about 1 million overnight stays compared to the winter of 2021/22. The effect of the appreciationof the Swiss franc will be mitigated by the fact that inflation is significantly higher in many European countries than in Switzerland. Tourism services, such as hotel accommodation or ski resort tickets, tend to become more expensive than in Switzerland. This effect should almost cancel out the negative impact of the appreciation of the Swiss franc. With a 26 percent growth of 1.1 million overnight stays, European demand in the coming winter will be only slightly below the pre-crisis level. Summer 2022 confirmed that the trend toward domestic vacations by the Swiss, which emerged during the Covid-19 crisis, continues. BAK Economics assumes that this trend will continue in the winter of 2022/23, albeit somewhat weakened: compared to the strong period of the previous year, domestic demand is thus expected to fall by only 2 percent. Overall, the good momentum of summer will thus be slightly slowed in winter 2022/23 by the difficult circumstances, but the positive effects clearly outweigh the negative ones. With a total of 16.5 million overnight stays (up 13 percent from the previous period), it will just miss the pre-crisis level (2019).

Overnight stays will not return to pre-crisis levels before winter 2023/24

The negative factors mentioned above will negatively impact tourism demand until the summer of 2023 and prevent a timely return to the previous pace of growth. Therefore, the pre-crisis level of overnight stays can only be reached in the winter of 2023/24. Impetus will then come mainly from the steady and general recovery of demand from long-distance markets and the gradual return of Chinese guests, which will begin as early as late summer 2023.

Para-hotel industry gains market share

The paralberge industry has clearly been less affected by the crisis than the hotel industry, thanks to tourists’ growing need for peace, nature and seclusion. BAK Economics predicts that the growth in favor of the paralberge industry will continue over the next two years. However, whether the shift in demand will continue in the long term will also depend on the future development of the quality of supply in the paralberge industry.For successful and sustainable development, existing facilities must be specifically adapted to changing needs, and quality must be increased through investment.

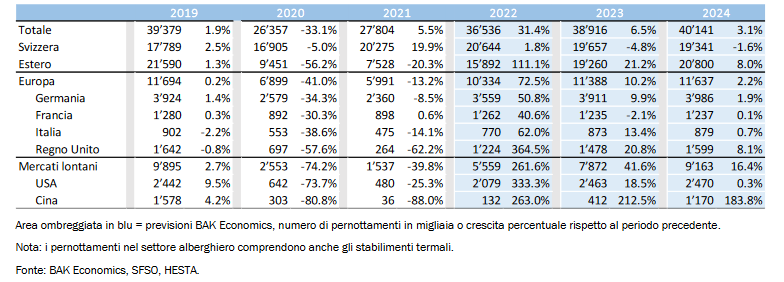

Development of overnight stays in the hotel sector by origin and tourist year

Source: BAK Economics