January 31, 2026

Individual taxation as an assault on families and federalism

Bureaucracy, billion-franc costs and social injustice: why we must say NO to individual taxation and YES to fairer, federal solutions

February 20, 2025

Abolition of rental value in Switzerland

Abolition of rental value: parliament gives green light, but with possible cantonal tax on second homes

February 20, 2024

Value Added Tax (VAT) Rates Worldwide: Overview of Consumption Taxes

The Value Added Tax (VAT) is one of the primary revenue collection tools in many countries around the world and can vary significantly from…

January 14, 2024

New VAT rates in force in Switzerland

As of January 1, 2024, the new tax rates approved in the September 25, 2022 vote took effect in Switzerland

June 23, 2023

Electronic Highway Vignette Coming Soon

Starting August 1, 2023, an electronic sticker (e-vignette) will be introduced as part of a dual system for the use of Swiss national roads…

November 25, 2022

Swiss motorway vignette 2023 is yellow

From December 1, 2022, the new highway sticker with a yellow background having the year on the red sticker side and white on the other side…

August 25, 2022

Withholding tax reform

In order to keep Switzerland as a business location attractive and competitive, the Federal Council explained why it is necessary to amend…

March 22, 2022

Facilitated taxation for Italian pensioners abroad

Italy provides various benefits for Italian pensioners living abroad (AIRE) and this year new benefits have been introduced.

January 21, 2022

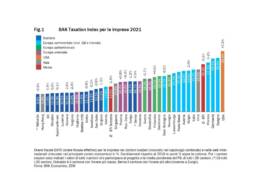

Swiss cantons improve their fiscal attractiveness

The "BAK Taxation Index" unveiled a drop from 16.9 percent to 13.9 percent in ordinary burden, using 2017 as the "pre-RFFA" baseline year

October 10, 2021

Corporate taxation: Switzerland requests more certainty from the OECD

Berne would like to see safeguards for the interests of smaller, economically strong countries and greater regulatory clarity for the…

June 2, 2021

When the real problem is not the “how much” but the “why”

The issue of tax pressure in Italy is never addressed from the point of view of the people, but always and only from the technical point of…