Draghi in 2011: “Federalism helps public accounts”

The Governor of the Bank of Italy evoked local taxes associated with a reduction of taxes at the center and new decentralized tasks subject to controls of legality

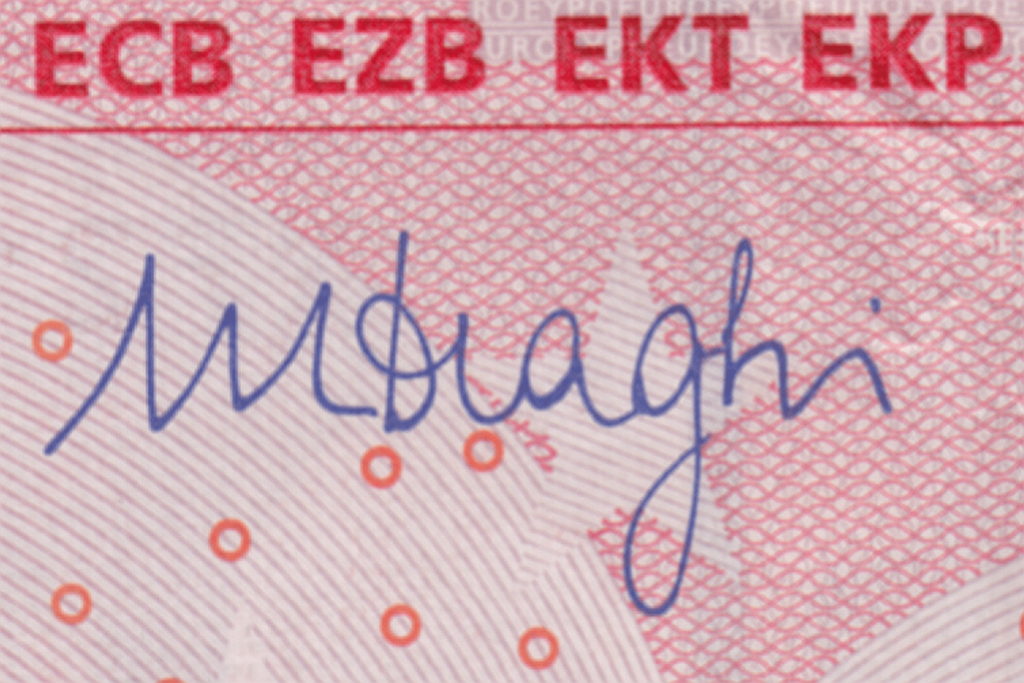

On the eve of beginning his adventure as President of the European Central Bank, which will last eight “long” years in the offices of Frankfurt am Main until October 31, 2019, Mario Draghi issued a warning for the future in his Final Considerations and in the text of the Annual Report for 2010 of the Bank of Italy.

Stating that “we need to return to growth, that decline is not inevitable for our country”, the Roman academic and economist alluded to Italy in the midst of the crisis of the 2011 season, in which “the super-technical executive” of the Bocconi’s Mario Monti took over from the government of Silvio Berlusconi, disliked by Brussels.

Preliminary agreement between the Government and the Emilia-Romagna Region (in Italian)

Preliminary agreement between the Government and the Lombardy Region (in Italian)

Preliminary agreement between the Government and the Veneto Region (in Italian)

Today (at the time, ed.) it is necessary, first of all, to bring the public budget back to an element of stability and propulsion of economic growth, bringing it into balance without delay, proceeding to a recomposition of expenditure to the benefit of growth, reducing the tax burden on many honest workers and entrepreneurs,” added the then Governor of the institution of Via Nazionale.

A real opening to differentiated regionalism

For Mario Draghi, federalism could lucidly help in the management of public accounts. However, on two conditions: that the new local taxes are accompanied by a cut in taxes at the center; that there is a control of legality on the new decentralized tasks.

”Fiscal federalism can help,” he said, ”by making all levels of government responsible, imposing strict budget constraints, and bringing citizens closer to the management of public affairs. Two conditions are crucial: that the new local taxes are compensated by cuts in those decided centrally, and do not add up; that there is a tight control of legality on the entities to which decentralization entrusts extensive spending responsibilities.”

Bank of Italy Annual Report 2010 (in Italian)

In his latest Final Considerations, Mario Draghi defined as appropriate the intention to bring forward to June the corrective maneuver and the objective of balancing the budget in 2014 and called for a rebalancing of the flexibility of the labor market.

Evoking measures that are still topical, he also called for a reduction in the burden of taxation on businesses and work, offsetting the loss of revenue with the recovery of evasion; and in the face of the sovereign debt crisis, he insisted that national policies implement corrective plans.

Insufficient infrastructure

In addition, it issued a warning that can also be effective in contemporary Italy: the country “lags behind in terms of infrastructure compared to other leading European countries“.

In addition, “programme uncertainty, shortcomings in project assessment and in the selection of works, fragmentation and overlapping of competences, inadequate rules on the awarding of works and checks on progress have resulted in our works being less useful and more expensive than elsewhere”.

On May 31, 2011 Mario Draghi also recalled the delays in the completion of works and the poor use of public and community funds, for which some territories are, however, much better than others.

“It is necessary to recover efficiency in spending, also to take full advantage of the resources of private concessionaires and community ones, which do not weigh on public accounts”.

EU funds used for 15 percent

Mario Draghi, whose experience outside Italy extended in Switzerland to the role of board member of the Bank for International Settlements in Basel, also pointed out that “the works to be carried out are worth 15 billion” and that “the EU structural funds currently available to us are only spent for 15 percent, those not spent amount to 23 billion. So, followed ten years ago Mario Draghi, “accelerate all these interventions would give a strong impetus to economic activity.

A maneuver “timely, structural, credible in the eyes of international investors, growth-oriented”, could “limit the negative effects on the macroeconomic framework”, and it is very easy to find analogies with the Italy of 2021 at the time of the coronavirus.

The agreements between Italy and Emilia-Romagna, Lombardy and Veneto

Italy, why differentiated autonomy “is” the Constitution

Italy, the legitimate implementation of differentiated autonomy

According to the then Governor of the Bank of Italy and since June 24, 2011 of the ECB, it was necessary “a shrewd articulation of the maneuver, based on a fundamental examination of the budget of public bodies, item by item, commensurate with the objectives of today, regardless of past spending“.

Finally: “Refining the efficiency indicators of the various public service centers (offices, schools, hospitals, courts) in order to achieve widespread improvements in the organization and operation of structures; continuing the efforts already underway to make public administrations more efficient; using part of the savings thus obtained in infrastructure investments”.