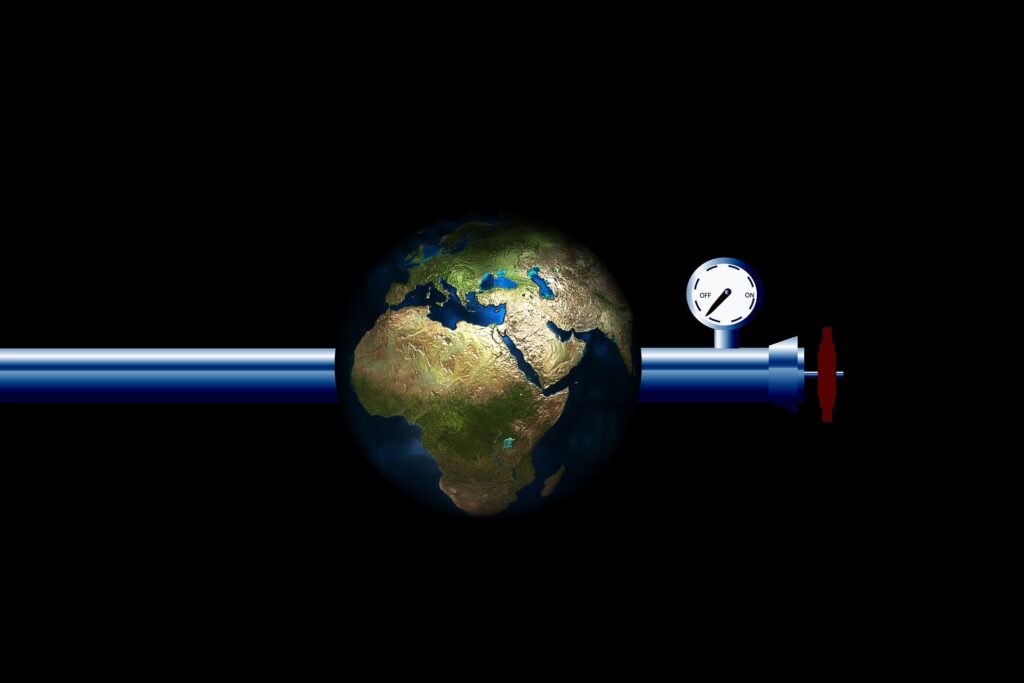

Oil and gas: The investment gap dilemma

The 2022 energy crisis produced higher prices and policy changes that encouraged investment in the oil and gas sector again.

In a nutshell

-

-

-

-

-

-

-

-

-

-

- Energy industry is cyclical, and so is its investment pattern

- The energy transition shortens the industry’s planning horizon

- Prices remain the most decisive factor in energy investment

-

-

-

-

-

-

-

-

-

The rapid rise in energy prices in 2022 that followed the recovery from the Covid-19 pandemic and the volatility triggered by Russia’s February 24 attack on Ukraine have caused fears of a potential scarcity of supply and intense competition among buyers over a limited pool of resources. Many wonder how long this chaotic situation can last and if an even more severe crisis may be brewing due to underinvestment in energy – the so-called “investment gap.”

Often used loosely, the concept of an investment gap has not been well defined. Put simply, it refers to the difference between actual investment and the investment needed to meet future demand. The implication is that insufficient investment today will not generate enough energy supplies in the future.

In oil and gas, the argument is often made that the world is already bearing the high cost of constrained supplies due to lower investment since the collapse in oil prices in 2014. The current energy shock is a manifestation of the problem that will only worsen unless investment picks up significantly, the reasoning goes.

Minding the gap

Indeed, investment in oil and gas is below the high levels seen in the early years of the last decade. However, the oil and gas industry has always gone through cycles of feast and famine, often in response to prices whereby high prices spur investment, and low prices depress it.

Unless there is an official ban on such investment, investing in oil and gas will continue to be directed by the rate of return.

The proponents of an “investment gap” argue that today the situation is different because of the energy transition, which limits the availability of fossil-fuel financing and spurs adverse government policies and regulations. That is undoubtedly playing a role, but it is not powerful enough to curtail investment notably. On the contrary, today, the energy crisis has significantly supported hydrocarbon investment.

Unless there is an official ban on such investment, investing in oil and gas will continue to be directed by the well-established and most potent indicator: the rate of return. And that, in turn, is affected by several factors, chief among them are oil and gas prices. Markets have also been quite efficient in allocating resources to those projects that generate the highest rate of return. This process has helped the world avoid long periods of scarce supplies. It is unclear why that principle and mechanism should have become different today.

There is no shortage of industry publications (some of them are cited in this report) warning of the looming dangers of lower levels of investment in energy in general and oil and gas in particular. Since less investment today means less production tomorrow, the authors point out, this spells trouble to energy importing countries scrambling to find new supplies and reduce the economic cost of high energy prices.

Will Norway turn the energy crisis into opportunity?

Can electric vehicles deliver a just energy transition?

Oil markets: An early peek into 2023

Energy investments cost a bundle

The numbers put forth are eyewatering. OPEC estimates that cumulatively, required oil-related investments by 2045 will come to around $12.6 trillion, with oil and gas exploration and production – so-called “upstream” – capital expenditure taking the lion’s share ($9.9 trillion). The bulk of these investment requirements will be needed in Organisation for Economic Co-operation and Development (OECD) countries, given the relatively high cost of development and production in areas such as North America and the North Sea. Such capital expenditure is needed to sustain production growth to meet projected demand increases and offset the natural decline in oil fields. If those investments do not materialize, we should brace ourselves for an extended period of high oil and gas prices.

A 2022 study by Goldman Sachs claims that because of investment delays in oil and gas projects since 2014, the world will lose 10 million barrels a day (or another Saudi Arabia) and 3 million barrels per day of oil equivalent in liquefied natural gas (LNG) (or another Qatar) by 2024-25. “In upstream oil and gas, the industry at the peak was spending $900 billion per annum, which troughed at $300 billion in 2020, so a two-thirds reduction in apex. … We have exhausted all of the spare capacity in the system, and can no longer able to cope with supply disruptions like the one we are currently witnessing because of the Russia-Ukraine conflict,” the bank warned.

Energy is a cyclical industry

Such concerns, however, are reminiscent of similar statements repeatedly made over the last two decades.

In its 2009 World Energy Outlook, the International Energy Agency (IEA) claimed that energy investment worldwide plunged in 2008 because of a stricter financing environment, weakening final demand for energy and lower cash flow. Most companies subsequently announced cutbacks in capital spending and project delays and cancellations in the oil and gas sector. The agency warned that the fall in energy investment would have far-reaching and potentially severe consequences for energy security.

If prices are supportive, investments will follow and will be sufficient to ensure that supply matches demand, at least in the medium term.

Two years later, in its April 2011 World Economic Outlook, the International Monetary Fund suggested that global oil markets had entered a period of increased scarcity. “Given the expected rapid growth in oil demand in emerging market economies and a downshift in the trend growth of oil supply, a return to abundance is unlikely in the near term,” the IMF concluded.

A few years later, however, investment rose to 30-year record levels as a share of global gross domestic product. The world was swimming in too much oil and enjoyed a relatively long period of lower prices.

That is not to discredit fears of tight markets and continued volatility but to highlight the cyclical nature of the oil and gas industry. When prices rise, investment follows suit, resulting in greater supplies a few years later. Those, in turn, put downward pressure on prices and investment, subsequently lowering future supplies and putting upward pressure on prices, and the cycle goes on. One OPEC report in 2018 puts it wisely: “if prices are supportive, investments will follow and will be sufficient to ensure that supply matches demand, at least in the medium term.”

Several investment drivers

In addition to oil and gas prices, several other factors influence investment. They include costs, technology, efficiency gains, demand and government policies, but most of these factors are related to prices. For instance, on average, costs follow prices with a time lag of six to nine months.

Furthermore, estimating the weight of those factors and their net effect on investment is difficult. One needs to consider the wide range of variables in the model, including the variety of assets in the sector – from onshore to offshore, conventional and shale – and different company strategies. Also, the investment decisions of national oil companies are driven by a broader set of considerations than their private counterparts. And countries have different policies and priorities.

For example, according to the IEA, almost half of the additional capital investment made in the oil and gas sector in 2022 is likely to be eaten up by higher costs. The agency warns that concerns about cost inflation are a brake on the willingness of companies to increase spending. According to OPEC, however, technological and efficiency improvements continue to partially offset higher costs.

One IMF study shows that between 2018 and 2020, oil and gas investment was also affected by the demand outlook under climate policies such as bans on internal combustion engines. The study found that if public awareness of the energy transition had been the same as in 2014, investment in “brown” energy (that is, using fossil fuels as opposed to “green” energy) would have been 38 percent higher in 2020.

However, the study adds that the pandemic has likely further penalized such investment, probably through unprecedented uncertainty, given that 18 percent of the 2020 decline is not fully explained by the econometric model used in the study. Its data analysis from 1970 to 2019 confirms that oil and gas prices have been the main drivers of capital expenditure.

Comparisons are risky

Furthermore, a fundamental problem lies in comparing investment today with past figures, as OPEC sensibly warns in a 2018 report. The publication of the producers’ group challenged the reference made by third parties to investment undertaken in the 2012-2014 period, arguing that “absolute levels of upstream investment in 2012–2014, in particular, were abnormally high, and thus do not serve as an appropriate comparison baseline.” They are also a reflection of the high costs that prevailed then.

The increased focus on energy security adversely affected the performance of clean energy indices relative to fossil fuels.

The study adds that there is no direct one-to-one conversion of investment volumes into barrels of oil production. For instance, non-OPEC production grew reasonably in the early 2000s when absolute global upstream capital expenditure levels were far lower than in recent years. Through efficiency gains, focus on best acreages and wells and re-fracking of shale wells, for instance, the industry has recently been able to raise production without increasing its capital expenditures proportionately, according to Deloitte.

And while some worry about the lower level of investment in oil and gas, the IMF’s Global Financial Sustainability Report, published in October 2022, found that fossil fuel investment remains high. The increased focus on energy security appears to have adversely affected the performance of clean energy indices relative to fossil fuels.

The report finds that this weaker performance has occurred despite solid investor demand for low-carbon assets and a substantial decline in renewable energy costs in recent years.

Scenarios

The consensus today is that the ongoing energy crisis, which has translated into higher prices and favorable government policies, is providing a stronger impetus for investment in the sector.

Activity picking up

Drilling activity to explore, develop and produce oil and gas is picking up almost everywhere, with the number of discoveries notably higher than a disappointing 2021. Goldman Sachs expects an end to the seven years (2015-2021) of hydrocarbon underinvestment, particularly in United States shale, LNG and deepwater oil projects in Brazil, Guyana, the Gulf of Mexico and West Africa.

Similarly, OPEC sees the backlog of upstream projects delayed by lockdowns and waves of Covid-19 infections beginning to clear. That leads to a steady stream of new fields coming online in countries and regions such as Brazil, the U.S. Gulf of Mexico, the North Sea and Kazakhstan, as output in newcomers Guyana, Senegal and Uganda increases. The recovery is also stimulated by supportive fundamentals, “with demand rebounding and markets clamoring for crude.”

Investors generally show greater discipline than in previous years. They are allocating more capital to greening their activities, including investing in carbon capture and storage technology, hydrogen and other green projects.

Energy transition impact

Some analysts also maintain that companies are shifting away from projects with long payback periods and long cycles because of the energy transition. However, according to the Norwegian Petroleum Directorate, several companies have adjusted the required return for upstream activities to around 20 percent to ensure through capital rationing that only the investment opportunities with the highest return are realized.

Robert Pindyck, an economist from the Massachusetts Institute of Technology, once said: “the investment behavior of firms, industries, and countries remains poorly understood. Econometric models have had limited success in explaining and predicting changes in investment spending.” We will know the impact of investment in oil and gas on future production capacity only ex-post after we have all the facts.

Facts & figures

Energy investment facts

- Clean energy investment is expected to exceed $1.4 trillion in 2022, accounting for almost three-quarters of the growth in overall energy investment (IEA).

- Required yearly future upstream spending is to average $400 billion between 2026 and 2030 (OPEC).

- A 10% increase in oil and gas prices typically raises global oil and gas investment by 3% in the same year and 5% after two years, cumulatively (IMF).

- Three-quarters of the CO2 reductions from a globally efficient mitigation in the next decade would come from reduced use of coal rather than oil and gas (IMF). The global upstream industry is projected to generate its highest-ever free cash flows of $1.4 trillion by the end of 2022 (Deloitte).

Author: Dr. Carole Nakhle founder and CEO of Crystol Energy

Source: