The canton of Zug is not satisfied: taxation even lower…

An initiative accepted by 67% of voters will create new deductions and “mini” rates for three years, in a place already free of taxes up to 50 thousand CHF

Did you know that the Canton of Zug (Kanton Zug), a beautiful hidden gem in Central Switzerland, offers one of the best tax environments in the world?

The maximum corporate taxation is, in fact, 11.91 percent, but easily lowered to around ten.

The taxation of natural persons is the lowest in the Swiss Confederation: On the first CHF 50,000 gross, the tax burden is almost non-existent, while the marginal rate is 21.80 percent and is only triggered by the threshold of one million francs, a figure almost unimaginable in other countries.

By way of comparison, the minimum (minimum!) tax rate in Italy is 23% and is triggered by a threshold of 15,000 euros; in France you pay 30% tax from just 25,711 euros. Not bad, eh?

Cantonal tax rate at 80% between 2021 and 2023

Despite this, on Sunday, March 7, the citizens of Zug voted on a further lowering of cantonal taxes. In fact, Switzerland has four referendum slots each year, one for each season. People vote on federal, cantonal and municipal initiatives.

The Zürich electorate has come out in favor of the tax law amendment, dated August 27, 2020.

A group of experts will improve the Swiss tax place

Taxation, sixteen fields of action for the Switzerland of the future

Yes to the consultation on the Swiss tonnage tax

The draft contains several measures to address the financial consequences caused by the Coronavirus. The population has expressed itself unequivocally: 67% of the population voted in favour.

The population and the economy as a whole will thus benefit from the temporary reduction of the cantonal tax rate from 82 to 80 percent for the fiscal years 2021 to 2023.

Deductions from CHF 11,100 (single) to CHF 22,200 (married)

In addition, the further increase in personal deductions in 2021 will allow a wide range of residents and domiciled persons in the Canton of Zug to be helped and gratified by the tax measures.

For the tax years 2021 to 2023, deductions are now adjusted according to inflation to CHF 11,100 (for single persons) or CHF 22,200 (for married couples).

New simplifications and facilitations for rents and leases

Finally, the new cantonal tax law also includes facilitations for tenants, in terms of expansion and simplification of deductions for rents.

It is now possible to deduct 30 percent of the apartment rent up to a maximum of 10,000 francs.

The purpose of this new tax law is to maintain the attractiveness of Zug’s living space and to ensure the strength of the entire economic area around the Zugersee.

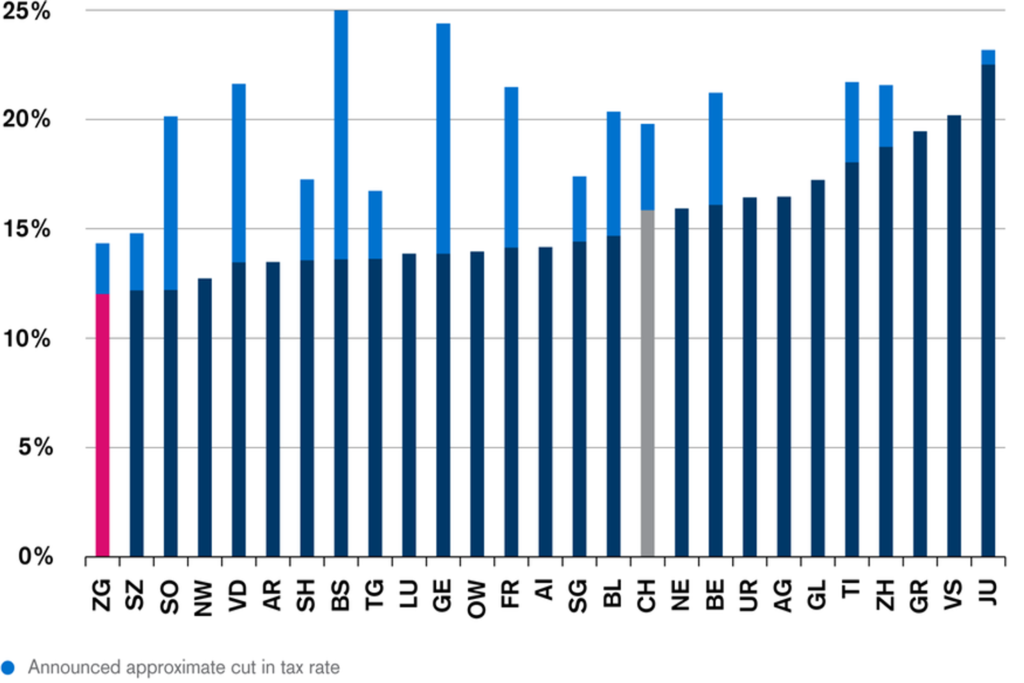

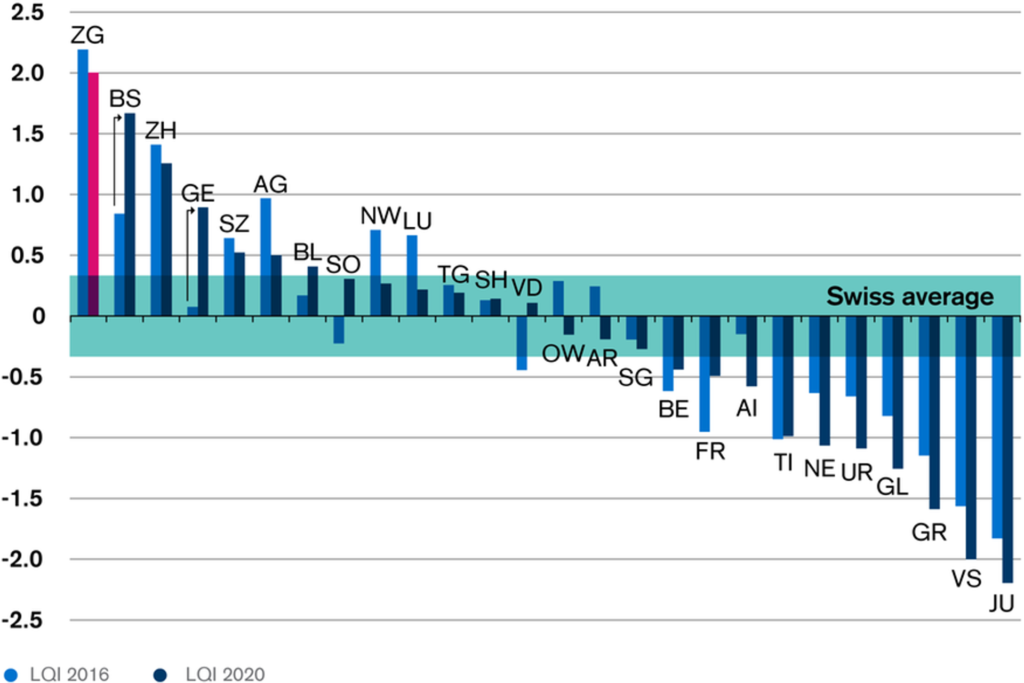

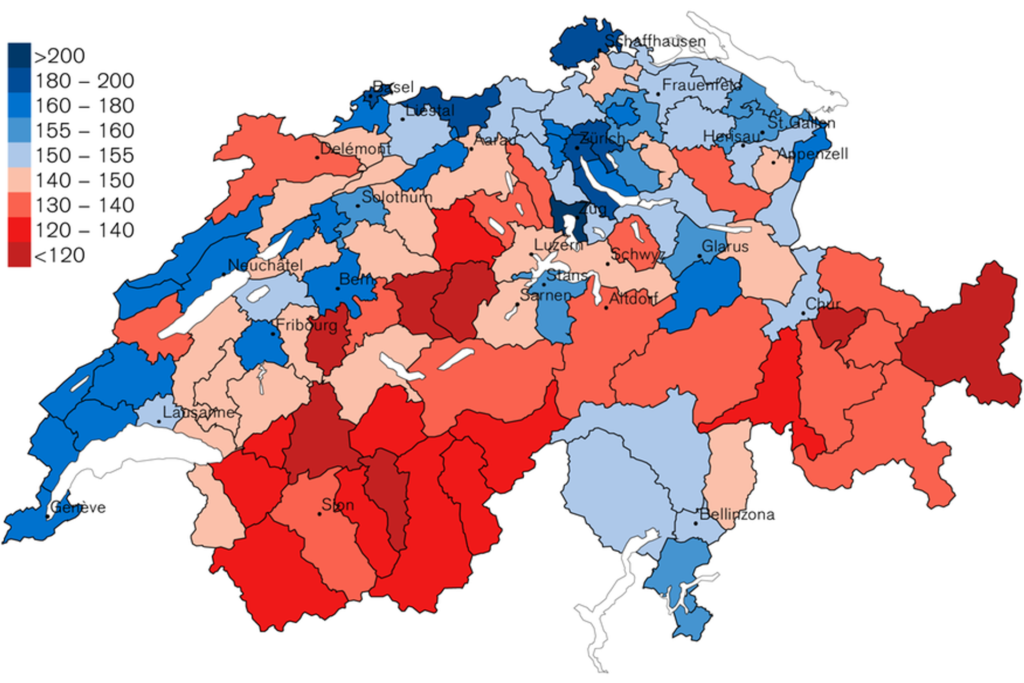

High quality of life and a “tax & business friendly” environment

Understand, then? This is the mentality of economically liberal nations: systematically increase the framework conditions that make them “tax & business friendly” and guarantee a high quality of life.

In 2025 Nidwalden will be the best “tax haven” in the world.

The difference between what you give and what you receive is the residual tax burden.

The income of Swiss households is high, but…

Let us therefore draw a veil over those who, at certain latitudes, dare to speak of these jurisdictions in “predatory” terms.

Not of countries that offer well-being and hope, but of states that “subtract resources” from fiscal, bureaucratic and, alas, quality and safety hells.