Switzerland “free port” for highly qualified workers

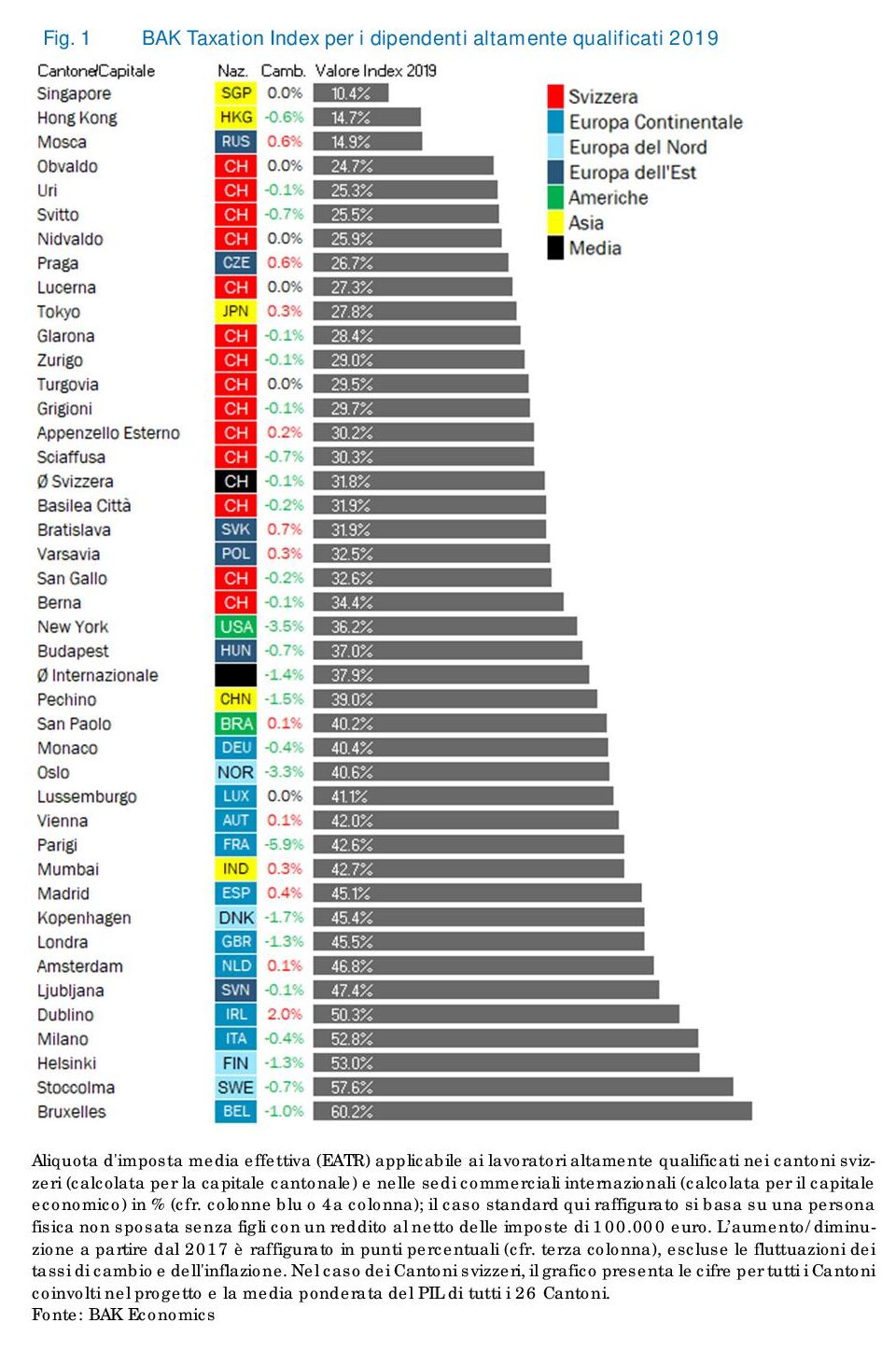

Despite an increase in payroll tax competition, the burden of Switzerland’s 26 cantons, led by Obwalden and Uri, is lower than the 37.9% global average

The BAK Taxation Index reports an increase in payroll tax competition and social security contributions for more educated workers compared to 2017. Major international players, such as France and the United States of America, have recently reduced taxes in this area significantly.

Since the Swiss cantons decided to rethink their tax policy, they continue to perform well compared to other countries: all twenty-six members of the Confederation impose a lower tax burden than the international average.

In particular, European rivals continue to tax the most highly trained workers at significantly higher rates. After the City-State of Singapore (10.4%), the Chinese Special Autonomous Region of Hong Kong (14.7%) and the Moscow Oblast (14.9%) come the cantons of Obwalden, Uri, Schwyz, Nidwalden and Lucerne with a tax rate between 24.7% and 27.3%, only interspersed with Prague (26.7%) and followed by Tokyo (27.8%).

Significant reductions in France, USA and Norway

Companies are interested in international tax competition, which is also becoming much tougher. This is shown by the 2019 edition of the Taxation Index published in Basel, Zurich and Manno by the BAK Economic Intelligence Institute, a tool that measures the actual tax burden on companies for hiring a highly qualified, unmarried person without children, with an after-tax income of 100,000 euros.

Released regularly since 2003 in collaboration with the Leibniz-Zentrum für Europäische Wirtschaftsforschung (ZEW), the BAK Taxation Index measures the EATR (Effective Average Tax Rate) burden for highly skilled workers, i.e. the actual tax and contribution burden borne by the employees’ employers.

The calculation takes into account all relevant taxes, including the respective rules governing the determination of the tax base, e.g. the deductibility of employee contributions to social insurance and occupational, public and private pensions. Also included are social security contributions (provided they are taxable in nature), as well as social security charges and payroll taxes paid directly by the employer.

The average tax burden worldwide in 2019 decreased by 1.4 percentage points compared to 2017. Significant reductions in taxation were recorded in particular in France (-5.9 percentage points), the USA (-3.5) as well as Norway (-3.3).

China, Denmark, the UK, Finland and Belgium also recorded “minus signs” of at least one percentage point. However, increases in the tax level were recorded in some jurisdictions, especially in Eire (+2), but these as a whole had less impact when compared with reductions.

Compared to the international trend, the Swiss average in all cantons declined slightly (-0.1 percentage points). While it is true that the tax burden for high-skilled workers was reduced in a large number of cantons, it is also clear that in most cases it was only marginally reduced by governments.

Minus 0.7% in Schwyz and Schaffhausen

The biggest reductions were recorded in the cantons of Schwyz and Schaffhausen (-0.7 percentage points), but slight tax increases were also recorded in some of the Swiss states.

Despite accelerating competition, the Swiss territories continue to perform well in international rankings.

The 26 member states of the Swiss Confederation appear even more attractive when compared with their Western, Southern and Northern European rivals, almost without distinction.

For example, the average tax burden in Switzerland (31.8%) is around 10 points lower than that of its neighbors in Germany, France and Austria and more than 20 percentage points ahead of Italy.

The international level of taxation of the most qualified workers