One out of every eight Swiss francs is the child of financial activity

Gross value added of 88 billion and 345,000 full-time equivalent jobs are the result of the work of Swiss banks and insurance companies

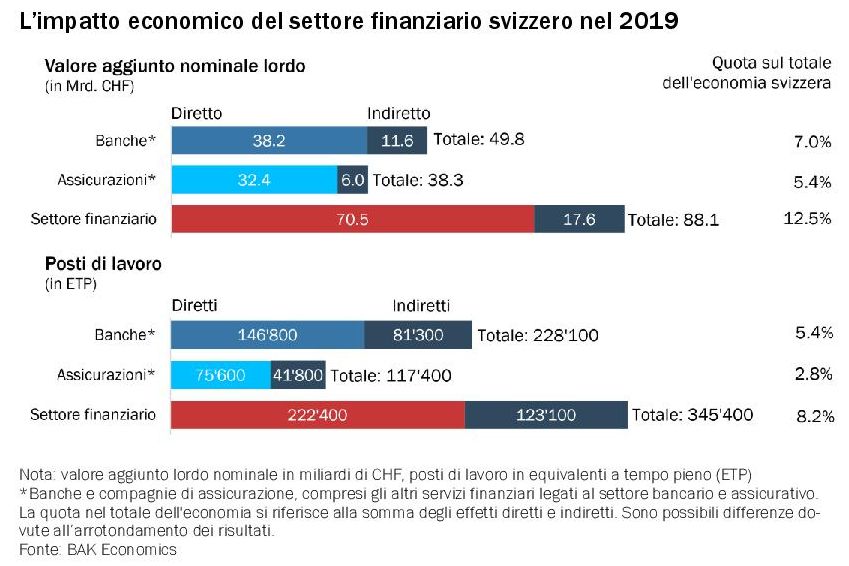

In 2019, the economic activity of the Swiss financial sector, including direct and indirect effects, generated a gross value added of CHF 88 billion and 345,000 full-time equivalent jobs. These values correspond to one-eighth of the total value added and almost one in twelve jobs in the Swiss economy.

Research commissioned by ASA and SBA

These are the main findings of an economic impact analysis conducted by BAK Economics on behalf of the Swiss Bankers Association (SBA) and the Swiss Insurance Association (SIA).

One of the main tasks of credit institutions is to provide funds to citizens and businesses. This is also true during the current pandemic period, during which Swiss banks have granted extraordinary loans totalling CHF 16.9 billion to counteract the lack of liquidity of companies.

The state has played a key role in protecting the economic infrastructure, as the federal government guarantees partially or fully (depending on the volume of the loan) for any defaults in the payment of debts.

BAK Economics’ economic impact analysis shows that the financial sector is not only an important provider of infrastructure services, but also a significant economic driver.

One-tenth of total economic output

With an added value of CHF 70.5 billion, this sector in fact generated 10 percent of Switzerland’s total economic output in 2019. In the same year, with more than 222,000 full-time equivalent jobs, one in twenty jobs in Switzerland was directly attributable to the financial sector.

The activities of banks and insurance companies generate impetus in other economic sectors as well, of course. In this sense, the financial sector’s demand for services from other sectors has a positive effect on the entire value chain. Trade and industry also particularly benefit from employee consumption.

For 2019, these indirect value-added effects were estimated at around CHF 17.6 billion. This figure was associated with approximately 123,000 full-time equivalent jobs. Including these indirect effects, for 2019, total value added amounts to 88 billion francs and employment to 345,000 full-time equivalent jobs.

12.7% of total tax revenue

This corresponds to one in eight francs of total value added and one in twelve jobs in Switzerland. For 2019, the direct and indirect tax revenue generated by financial sector activities is estimated at CHF 19.3 billion, a value that corresponds to 12.7 percent of the total tax revenue of the federal government, cantons and municipalities.

This value also includes tax revenues from indirect taxation of financial services and market operations as well as tax revenues related to economic activities in other sectors triggered by the financial sector.

Higher values if foreign countries are also included

The national accounts measure the economic performance of a country on the basis of Gross Domestic Product and the added value of its industries. At regular intervals, the methodology used to calculate the national accounts is revised by the Federal Statistical Office (FSO).

The revision for 2020 estimates that the value added of the financial sector in 2018 will be more than CHF 6 billion higher: this corresponds to an upward revision of almost 10 percent.

This difference is mainly due to adjustments in the definition of banks’ foreign assets. A higher proportion of the intermediate inputs purchased by the banks will now be allocated to business units located outside the Swiss borders.

As a result, the domestic value added of the banks, calculated as the difference between the value of production and intermediate consumption, will be higher. This methodological adjustment will therefore mainly affect large banks, which have a particularly large number of employees abroad.