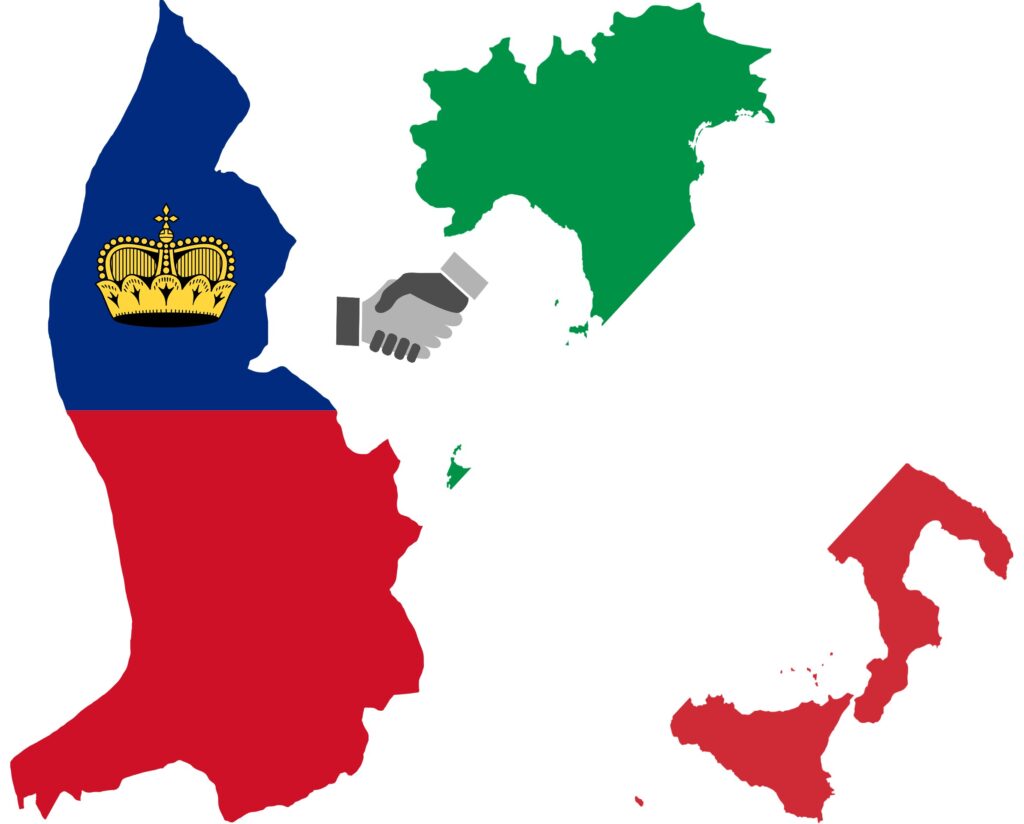

Liechtenstein and Italy sign against double taxation

As part of a virtual signing ceremony, Head of Government and Minister of Finance Daniel Risch, together with his Italian counterpart Giancarlo Giorgetti, signed the Double Taxation Convention (DTA) between Liechtenstein and Italy on July 12, 2023.

The DTA will enter into force after the completion of national legislative procedures. It should be considered a success that the DTA, already initialed in 2019, can now be signed. This was made possible by the continued efforts of the Liechtenstein government and authorities in the interest of Liechtenstein as a business location.

The agreement regulates the elimination of double taxation in cross-border situations. It is based on the OECD international standards and takes into account the results of the OECD/G20 Base Erosion and Profit Shifting (BEPS) project, which aims to combat the reduction and shifting of profits in a cross-border context.

100 Years of Switzerland-Liechtenstein Customs Treaty

The agreement regulates the prevention of double taxation and tax evasion in income tax matters. To promote cross-border investment, a zero rate for group dividends was provided for withholding taxes. Under the provisions on the mutual agreement procedure between the two countries, an arbitration clause and an additional protocol on arbitration proceedings were also agreed upon to resolve difficult cases of double taxation. The regulation on exchange of information is in line with international standards and provides for assistance from the enforcement office, so automatic exchange of information will continue to be handled through the AEOI agreement between Liechtenstein and the EU.

The agreement with one of Liechtenstein’s most important trading partners is further evidence of the long-term success of the government’s financial center strategy and is an extremely important step toward expanding Liechtenstein’s DTA network. It increases legal certainty for investment and strengthens joint cooperation between Liechtenstein and Italy.

Source: OTS