In Italy, the tax burden has risen to 43.1%

In 2020, annus horribilis of the tricolor economy, the weight of taxes and contributions returned to the level of 2014, 0.3 percent below the record of the year before

In 2020, annus horribilis of the Italian economy, the tax burden has risen, settling at 43.1 percent; the same threshold that in the Peninsula had been touched in 2014, just 0.3 percentage points from the historical record that FU recorded in 2013.

Italy, requested “certain times for differentiated regionalism”

Italy, “On diversified autonomy, the government is ready”

Fiscal pressure, recalls the CGIA di Mestre Studies Office in its own recently published research, which is given by the ratio of tax and contribution revenues to GDP.

Obviously, the 0.7 percentage point increase over 2019 is mostly attributable to the collapse of GDP, which fell by 8.9 percent last year. Although it was smaller than that recorded by the latter, tax and contribution revenues also nevertheless suffered a sharp decline in revenue (-6.3 percent).

In absolute terms, the tax authorities, INPS and social security funds collected 711 billion euros, 48.3 billion less than in 2019.

Italy, why differentiated autonomy “is” the Constitution

Italy, the legitimate implementation of differentiated autonomy

Despite these clarifications, makes known the Association of Artisans and Small Businesses Mestre Cgia is clear that the overall tax burden on families and businesses is a major problem.

It was before the pandemic, let alone now, with many companies at risk of closure and with many people slipping towards the poverty line.

CGIA: “Zero taxes for a year: relief from 30 billion”

It is also for these reasons that the artisans from Mestre return to reiterate that the provision of new support to micro and small enterprises that the Draghi government is developing in these days must be accompanied by a zero tax burden for the current year.

Otherwise, we risk that once collected, these reimbursements will be immediately returned to the State in the form of taxes, duties and contributions.

A roundabout already occurred last year that for many entrepreneurs represented a real hoax. This generalised cut in taxes and duties for the whole of this year would cost the tax authorities between 28 and 30 billion euros.

An estimate that was calculated by assuming that all economic activities with a 2019 turnover below one million euros would not pay IRPEF, IRES and IMU on warehouses for the current year.

These companies, which amount to about 4.9 million units (or about 89 percent of the national total), should still pay local taxes, so as not to cause cash flow problems for mayors and regional presidents.

Relieved of the burden of an often unfair tax, they would live for a year with less anxiety, less stress and more serenity. Not only that, but with 28/30 billion saved, we will lay the foundations to restart the economy of the country.

“Within July other 50 billions of non-refundable contributions”

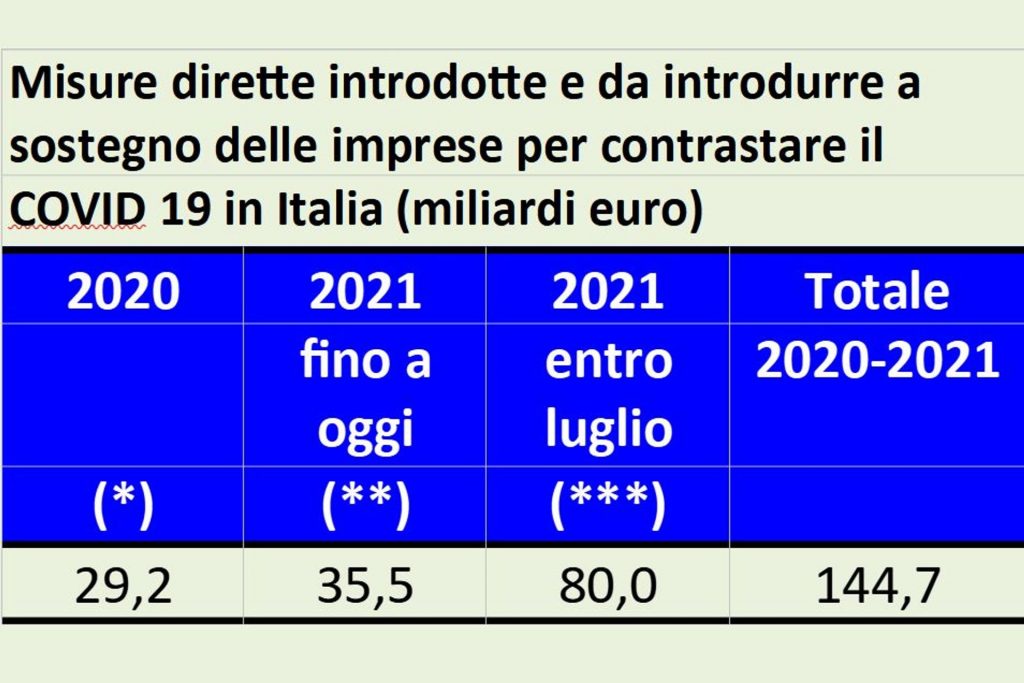

Beyond the zeroing of taxes, the Study Office of the CGIA hopes that the Executive will put on the table at least another 50 billion euros by next July that will allow to reimburse to a greater extent than it has been made until now the losses suffered by the companies and allow the entrepreneurs to compensate also a good part of the fixed costs sustained.

One hundred and sixty years of Italy, not even one of federalism…

That Italian Confederation born and buried in Zurich

This latter method has been applied by France and Germany for several months, having implemented the new provisions introduced by the EU regarding state aid to companies.

Costs, the fixed ones (such as rents, insurance, utilities, etc.) that, despite the obligation to close and the consequent zeroing of revenues, economic activities unfortunately continue to support.

This important effort must be made by the summer, a period in which, thanks to the effects of the vaccination campaign and weather conditions, we should have left behind the pandemic and be back to a situation of “normality”.

The withdrawal of the DDL “Autonomy” disrespect to Italy that works

Italy, “A centralist approach to the Recovery Fund”

To the indiscretions that have appeared in recent days, it seems that the “Support bis” decree in the process of being approved provides for the compensation of fixed costs, albeit to a very limited extent and totally insufficient to meet the demands of economic activities.