In 2025 Nidwalden will be the best “tax haven” in the world

The canton with capital Stans, co-founder of Switzerland more than 700 years ago, will take over from Hong Kong the palm of the “lightest” jurisdiction for companies

“One for all, all for one”, but in diversity and autonomy. The motto underlying the Swiss exception, in which powers are delegated to the Confederation that the individual cantons have explicitly decided not to keep for themselves, also applies to areas that elsewhere in Europe are the exclusive domain of nation states, central governments and general legislation.

It can therefore happen in the heart of the Old Continent and of modern Helvetia, which Canton Nidwalden conventionally helped to found on August 1, 1291 together with its “twin” Obwalden, under the common mantle of Unterwalden, and with the neighboring communities of Uri and Schwyz, that peaceful and liberal revolutions become concretely possible.

The Swiss half-canton with its capital Stans, bordered to the north by Lake Lucerne and in all other directions by mountain ranges, which only in 1997 abolished the popular assembly by a show of hands as the seat of legislative power, inhabited by just over 43,000 residents of predominantly German ethnicity and language, is preparing to become the absolute best jurisdiction for corporate taxation within the next few years.

An effect of the new Tax Reform

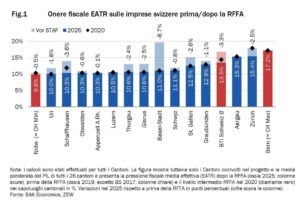

Since the beginning of 2020, the OASI Tax and Financing Reform has been in force: a regulation which aims to preserve the attractiveness and competitiveness of Switzerland as a business location, making it compliant and competitive at international level, guaranteeing jobs and tax revenues in the medium to long term, and at the same time ensuring the higher payments which the pension system needs to cover the pensions provided by the Old Age and Survivors’ Insurance. A time comparison of the ordinary pressure reveals what will be the profound benefits of the Tax reform:

The GDP-weighted Swiss average of all 26 cantons assumes a shift from 16.8 percent before the RFFA to 13.5 percent in the following five years.

In the popular vote on May 19, 2019, 42.7% of the electorate voted in favour of the tax reform and the financing of the old age and survivors’ insurance (AHV/AVS) with an overwhelming majority of 66.4% in favour, compared with just 33.6% against.

According to the Federal Council and Parliament, the draft represented a typical Swiss compromise that is both balanced and beneficial to the population as a whole. The effects began to be felt immediately, especially as the cantons of Vaud and Basel-Stadt took prompt action in 2019, the latter reducing business taxation by a record 8.7% to 11%. Six other Swiss cantons will record reductions of more than 5 percentage points, while twelve will limit themselves to one percent.

Assault on Chinese offshore stronghold

The interesting news is that once the reforms take effect in 2025, the Canton of Nidwalden will become the most advantageous place in the world for corporate taxation, depriving Hong Kong of its long-standing “leadership”. This is the thesis of the BAK Economics institute, with offices in Basel, Zurich and Manno, which on July 23 published the data of its Taxation Index, which punctually monitors the fiscal attractiveness of Swiss cantons compared to other countries.

Nidwalden will thus become the most attractive jurisdiction for resident companies, with an effective tax rate of 9.8%. A moderate reduction will be sufficient to take the top spot in the comparison of international values for 2019 away from the Special Administrative Region of the People’s Republic of China, a British protectorate until 1999.

At the Swiss national level, after the canton with the capital Stans come Uri (10 percent net) as well as Schaffhausen, Obwalden and Appenzell Ausserrhoden (all three at 10.3 percent).