Bern, Zurich and Aargau focus on fiscal innovation

Three Swiss Cantons with important research clusters, but so far “high taxation”, will reduce taxes for those who promote research and development activities and patent boxes

The Swiss Confederation will look decisively at incentives for innovation with a variety of regulatory instruments that will deploy their effectiveness from now until 2025, not least the tax lever, and will serve the purpose of further improving the attractiveness of the Alpine country.

In fact, with the introduction of the Tax and Financing Reform of the OASI (RFFA), further specific facilitation rules were introduced, namely the additional deduction for research and development activities and patent boxes.

The purpose of these tax “tools” – which are, moreover, internationally recognized – is to promote corporate modernization and renewal activities.

“Research & development” and patents galore

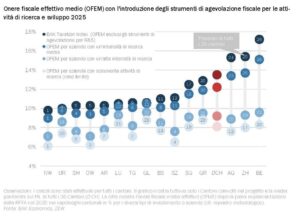

The analysis of the BAK Economics Institute, which has already examined in its own study the evolution of general taxation on a territorial basis, shows how these legislative interventions considerably reduce the tax burden for companies characterized by a high rate of “research & development” and patent filing.

The different implementation of these instruments has had the effect of modifying the order of particularly innovative companies on a local basis.

Finally, despite the fact that the cantons of inland and eastern Switzerland are still at the top of the list, it is worth noting the particular performance of the territories with important research clusters such as Bern, Zurich and Aargau (which traditionally rank among the cantons with high taxation), which recover important positions and prove to be the most attentive to the subject of tax breaks.