Three hundred and thirty thousand Scrooge’s in Switzerland

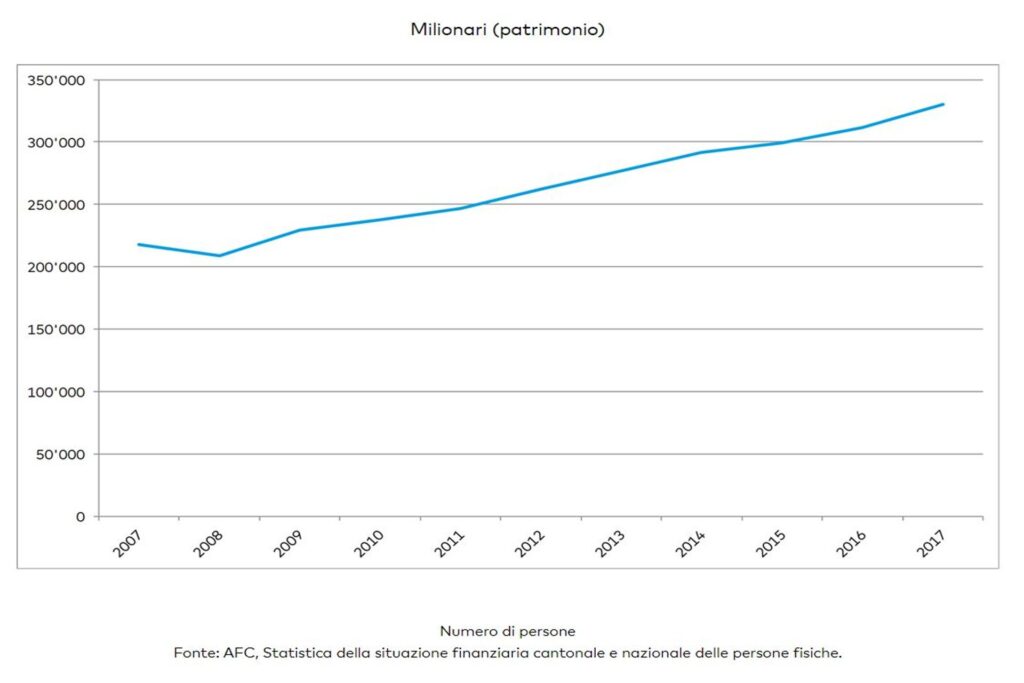

Between 2007 and 2017, the number of people whose assets exceed one million francs rose in the Swiss Confederation to a remarkable 52 percent

In addition to providing answers to numerous questions, the recent analysis by Cler Bank’s “Swiss Income Monitor” creates more transparency about the development and distribution of wages and income in Switzerland.

Did earnings increase between 2007 and 2017? Are there regional differences? How do they manifest themselves? How many millionaires are there in the Swiss Confederation?

At the top the income of Swiss households, but…

The number of millionaires (wealth) increases very significantly

Between 2007 and 2017, the number of millionaires (wealth) increased to a remarkable 52 percent, exceeding 330,000.

Thanks above all to the price of securities and real estate

This increase can be explained neither by inflation (which was practically nil) nor by migration, but is instead mainly due, in addition to the positive income development, to the development of securities and real estate prices.

The stock market crash caused by the 2008 financial crisis is also noticeable in this way.

Since then, however, the number of millionaires (assets) has been steadily increasing.

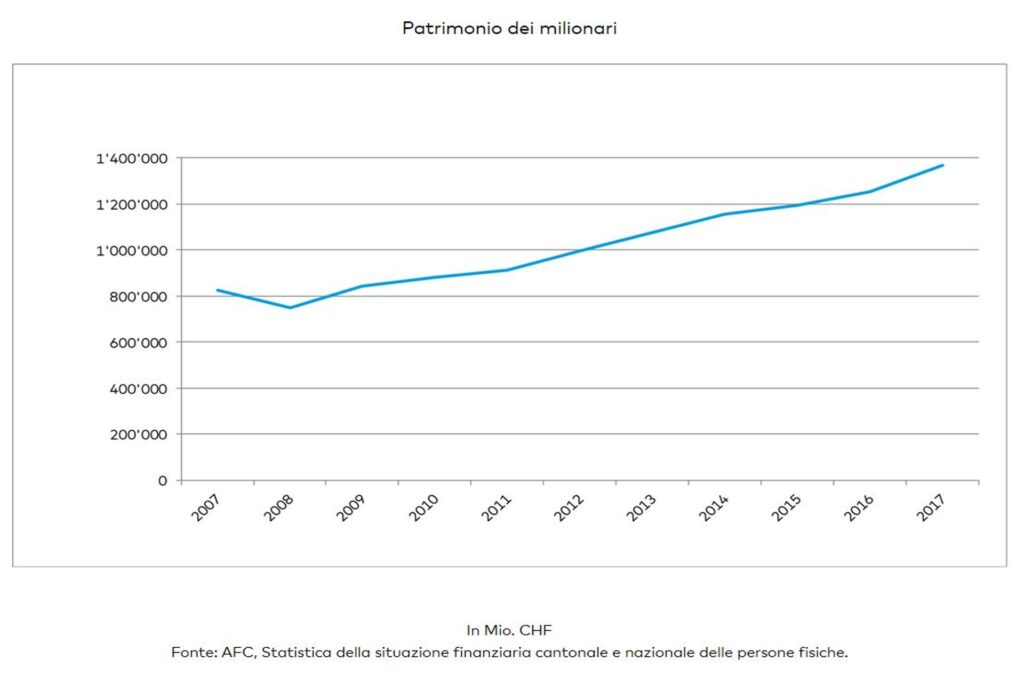

Since 2007, the assets of millionaires have increased by more than two-thirds (+65 percent) to a total of approximately CHF 1,368 billion in 2017.

Taxation, sixteen fields of action for the Switzerland to come

A group of experts will improve Switzerland as a tax centre

Between what you give and what you receive is the residual tax burden

The assets of Confederate millionaires up by 9 percent

Compared to the increase in the number of millionaires, the evolution of assets has been greater, thus increasing the average assets per millionaire (+9 percent).

This figure seems surprisingly low, but it is due to the fact that the relatively high assets of the “old millionaires”, which also grew strongly, were diluted (i.e. reduced) by the relatively low assets of the “new millionaires”.

Again, it can be seen that the financial crisis of 2008 had a slight influence.

Overall, the assets of all private households in Switzerland grew significantly.

In particular, real estate assets grew by 61 percent to CHF 1,997 billion during the observation period.

Current private assets amount to CHF 4,554 billion

Overall, the private wealth of Swiss citizens increased by almost 45 percent during the period under review to a total of CHF 4,554 billion.

Once again, it can be seen that the collapse of the financial crisis in 2008 affected financial claims (which, in addition to bank deposits and bonds, also includes equities, collective investment schemes and claims on insurance companies and pension funds), and thus also the total.

These asset values are gross. If financial liabilities of CHF 862 billion were deducted, the absolute net assets of private households in 2017 would amount to CHF 3,692 billion.

Up to CHF 6 billion to Switzerland and cantons from the National Bank

Digital tax return in Appenzell Ausserrhoden

Swiss SMEs saved more than 2 billion on duties