Bankruptcies and debt enforcement in decline throughout Switzerland

In 2020, corporate dissolutions and foreclosures fell by 6.6 percent (-18.2 in Ticino…) and 13.3 percent, respectively, compared to 2019

In 2020, the total number of bankruptcy filings against corporations and partnerships fell by 6.6 percent compared to 2019. In regional terms, the largest decline was observed in Ticino (-18.2 percent).

Closures of bankruptcy proceedings showed a similar decrease to openings. In contrast, a more pronounced decline was seen for enforcement proceedings.

Eröffnungen von Konkursverfahren nach Grossregionen und Kantonen

Ouvertures de procédures de faillite par grandes régions et cantons

Aperture di procedure di fallimento per grande regione e cantone

This is what emerges from the latest results of the statistics on debt enforcement and bankruptcy carried out by the Federal Statistical Office (FSO).

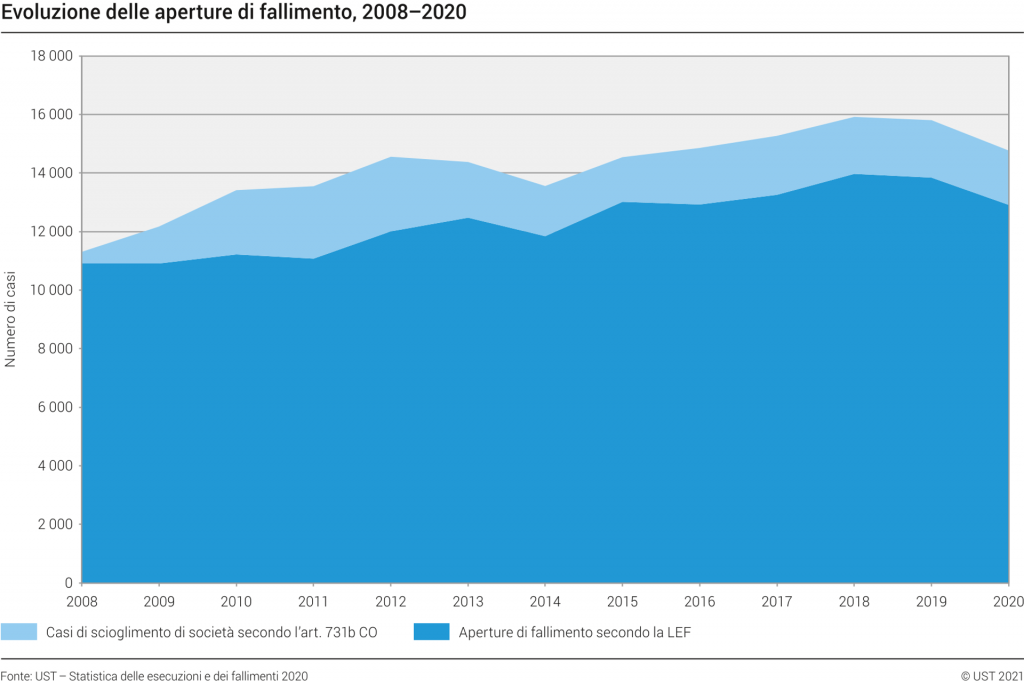

In 2020, the number of bankruptcy proceedings opened against companies and individuals under the Federal Act on Debt Enforcement and Bankruptcy (FEC) amounted to 12,912, marking a decrease of 928 cases compared to 2019 (13,840 cases).

The results return a partial view insofar as they do not include proceedings for dissolution of companies due to shortcomings in the organization (art. 731b Code of Obligations), the number of which has also declined in the period under review.

Increase in proceedings in only four out of 26 cantons

With regard to the number of closures of bankruptcy proceedings, including dissolutions under Article 731b of the Swiss Code of Obligations, the decline observed in 2020 (-946 cases) is almost of the same order of magnitude as the decline in the number of bankruptcy proceedings opened.

Compared to 2019, there was a decline in the number of bankruptcy proceedings opened in all “major regions”, ranging from -2.8 percent in Northwestern Switzerland to -15.9 percent in Ticino.

Konkursverfahren und Betreibungshandlungen

Procédures de faillite et actes de poursuite

Procedure di fallimento e procedimenti esecutivi

Looking at the cantons, Glarus (-26.6%) and Graubünden (-24.0%) showed the sharpest declines.

In absolute terms, the cantons of Ticino, Geneva and Vaud recorded the largest declines (more than 100 cases less than in the previous year). Only four cantons, including Lucerne (+32 cases) and Obwalden (+15 cases), registered an increase in the number of bankruptcies.

Largest drop in GDP since 1975 calls for caution

These results should be viewed with some caution. Since in 2020 the gross domestic product (GDP) fell by the largest amount since 1975, one might have expected a wave of bankruptcy proceedings against companies and individuals.

However, the results show a decrease in the number of bankruptcies in the year under review.

There are various factors which can explain this apparent paradox. The main reason lies with the authorities. The Federal Council took the decision very early on to temporarily suspend the obligation for companies to notify the judge in the event of over-indebtedness.

Eröffnungen von Konkursverfahren nach Grossregionen und Kantonen

Ouvertures de procédures de faillite par grandes régions et cantons

Aperture di procedure di fallimento per grande regione e cantone

It also allowed SMEs to apply for a “COVID-19 moratorium”, providing financial aid for hardship cases. These measures were taken in particular to avoid a wave of bankruptcies.

In this context, it is therefore difficult to know how to correctly interpret the 2020 figures.

Since the economic repercussions of the pandemic on the number of bankruptcies will extend beyond 2020, it is appropriate to wait for the 2021 or even 2022 figures to better understand the extent of the impact of the pandemic on the Swiss economic fabric and, more specifically, on the number of bankruptcies.

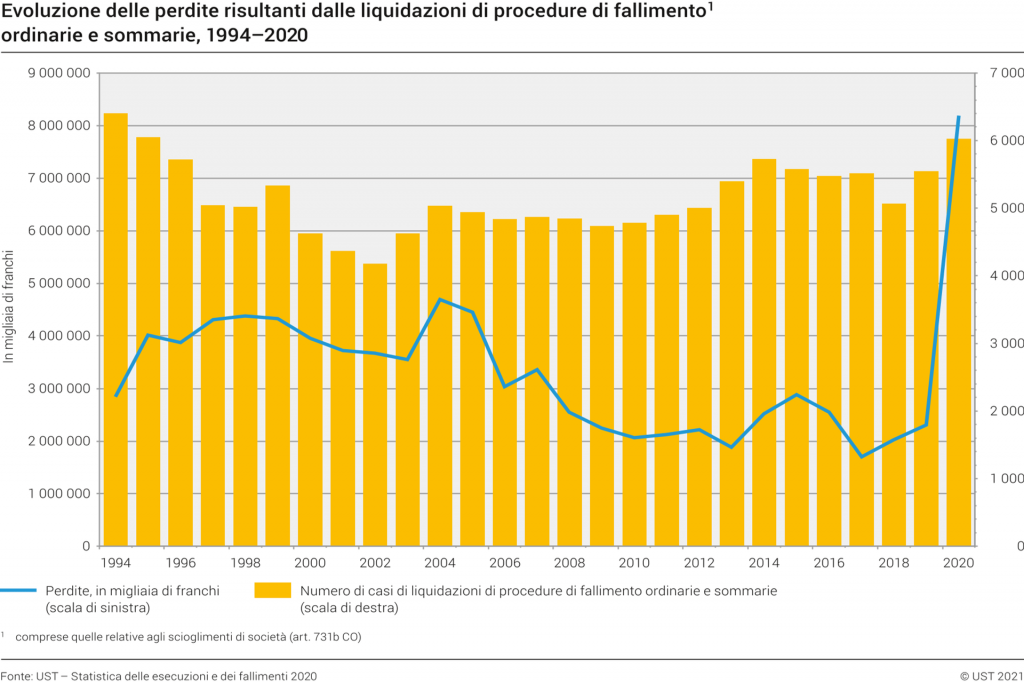

Large increase in the amount of financial losses

The amount of financial losses resulting from ordinary and summary bankruptcy closure proceedings (including dissolution proceedings under Article 731b CO) is significantly higher than in 2019.

In 2020, these losses amount to CHF 8.2 billion, which is 3.6 times higher than in 2019. This amount, a record since the beginning of the surveys, must be put into perspective, however.

Betreibungshandlungen nach Kanton

Actes de poursuites par canton

Procedimenti esecutivi per cantone

And this is explained by an unusual case of bankruptcy proceedings that were opened some 16 years ago and only closed in 2020.

This particularly long bankruptcy procedure, which ended with a loss of CHF 6.5 billion, is one of the most significant in the history of our country.

Without this case, the financial losses resulting from bankruptcies closed in 2020, a year marked by the economic crisis induced by the COVID-19 pandemic, would be at a level 30 percent lower than in 2019 (2.3 billion francs).

Significant drop in foreclosures and executions

The health crisis situation has also had a significant impact on the number of enforcement proceedings initiated or carried out in our country.

Indeed, 2020 saw fewer enforceable precepts (2.6 million, or 13.3 percent less than in 2019), foreclosures (1.5 million; -11.8 percent) and realizations (653,000; -5.6 percent).